Enhance and Bolster Trade Based Money Laundering, AML and KYC Compliance Reporting For Financial Institutions

With 7 years of expertise and proprietary AI algorithms, G2Lytics partners with financial institutions and third-party providers to strengthen AML and KYC processes while ensuring their ability to better respond to regulatory compliance and improve internal visibility into a growing fraud threat.

In an area where financial institutions lack visibility or guidance in how to target these new and expanding compliance aims of the government or strengthen internal systems, our approach to enhancing fraud detection at the FI level parallels the work we perform for trade-based money laundering, providing a significant head start to any similar fraud initiatives . This knowledge and existing architecture can greatly expedite an FI’s ability to fortify current detection and analysis.

Contact us to learn how our technology can protect your institution in this evolving regulatory landscape.

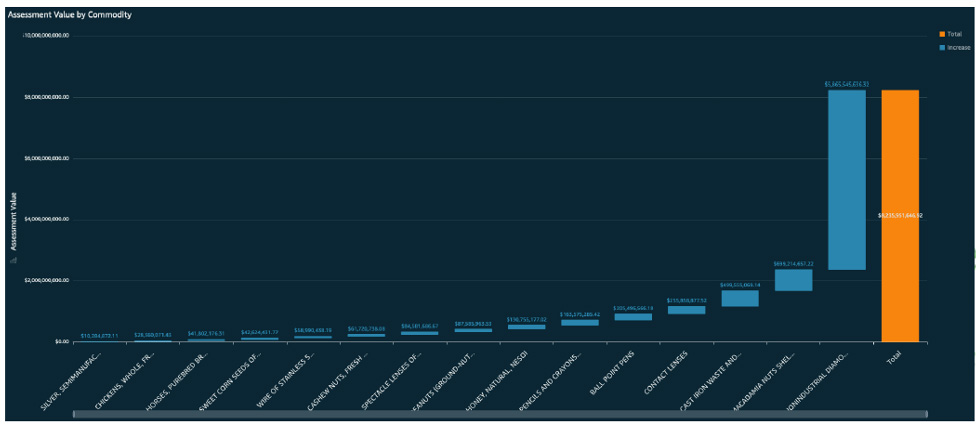

Transactional Analytics in report of Visual Presentation

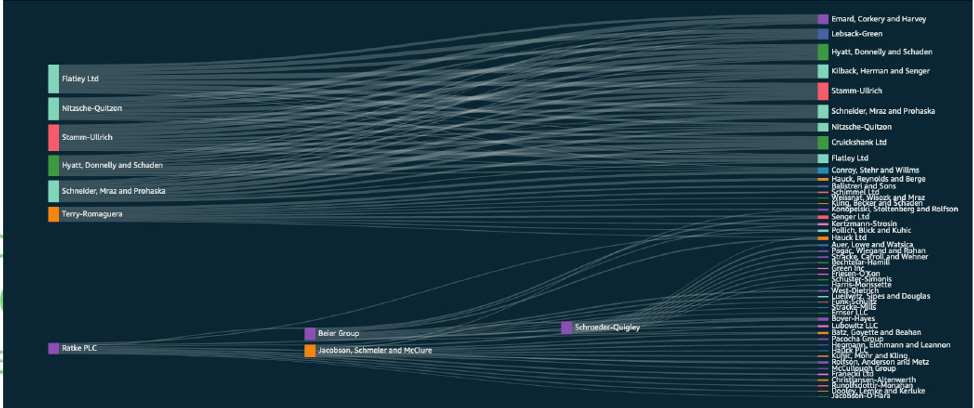

Network Analytics Exposes hidden Relationship & Entities

Our Comprehensive Financial Solution

We combine AML and trade data analysis, helping institutions achieve the following:

- Demonstrate DOJ compliance with new reporting requirements

- Enhance existing fraud detection capabilities

- Seamlessly integrate with current platforms through licensing options