G2Lytics nForce™

G2Lytics’ nForce™ platform specializes in machine learning enhanced approaches that target, detect, and report fraud and non-compliant behavior. nForce™ offers data processing, artificial intelligence, and advanced analytics to provide value to clients by activating and accelerating data manipulation. Our intelligence gathering precision dives deeper and faster to create actionable insight when time is critical and results are urgent. Customized analytics, powerful visualizations, and artificial intelligence assisted solutions combine to power the G2Lytics’ platform.

Fraud is never defeated. It simply reappears in different forms as the violators attempt to stay ahead of enforcement. nForce™ is designed to quickly and methodically detect and recognize many associations that other products do not. The process remains under constant improvement throughout a life cycle that encourages a client to actively engage in a continuous exchange of intelligence enhancements and identity techniques. This is further enhanced by supervised and unsupervised machine learning that constantly identifies new and ever-changing fraud schemes. As a relationship matures, intelligence becomes increasingly more effective, valuable, and actionable.

An Artificial Intelligence Accelerator from Proof Of Concept to Production

Trade Based Money Laundering

G2Lytics supplements the lack of resources available to stretched federal agencies to comprehensively view the massive amounts of data and information that must be processed, matched, and analyzed. G2L’s experience, and analytics techniques quickly identify “red flags” and additional signal anomalies present in the massive data sets that detect improper transfer pricing costs. This problem alone costs the Federal Government billions of dollars in uncollected taxes annually, is used to launder the proceeds of illegal activities, and may allow funding of terrorist activities across national borders.

OFAC and Sanctions Enforcement

Using proprietary fraud algorithms and red flag identification techniques, G2Lytics can assist the national security and financial intelligence bodies that regulate and sanction individuals and entities from foreign states who have been involved in some kind of fraudulent and non-compliant activity, such as drug trafficking, terrorism, terror funding, money laundering, and more.

Government Funded Projects

Covid relief, PPP, Infrastructure and other programs have urgently and inefficiently pushed TRILLIONS of dollars into the economy, creating unprecedented and unfettered fraud that traditional detection and prevention methodologies can not identify. Using the same fraud analytics as in other fraud applications, G2Lytics greatly enhances and expedites the agency’s ability to detect and act on violations, recover fraudulent funds and prosecute offenders.

Customs and Borders

G2Lytics’s fraud analytics greatly enhance the ability to identify importers who inaccurately report the type, value, and country of origin for the merchandise they bring into the U.S. and make sure they are paying the right import duties. But unscrupulous importers find many ways to subvert the government and gain an unfair advantage over their competitors.

Trade Management and Export Controls

G2Lytics systems are adept at identifying “red flags” consistent with trade and export and merge these flags with algorithms and data sets that quickly identify actionable violations and suspect transactions.

Financial Institution AML and KYC Embedded Analytics

G2Lyticsfederal's trade analytics solutions incorporate algorithms and expertise from financial anti-money laundering and trade monitoring. This allows nForce™ to adapt to financial AML, sanctions screening, and compliance reporting needs - addressing gaps in current fraud detection systems.

Areas of Specialization

Government Agencies

Federal Agency Use Cases

G2Lytics' proven AI-powered trade analytics platform, validated through collaboration with DHS's Trade Transparency Unit (2022-2023), delivers comprehensive AI_based trade surveillance and case management capabilities. Our advanced trade anomaly detection, backed by sophisticated machine learning algorithms that continuously evolve to identify emerging patterns and networks.

Financial Institutions

AML Compliance Reporting For Financial Institutions

Financial institutions must evolve beyond traditional AI-powered fraud detection systems to meet new regulatory requirements. While these internal systems remain valuable for identity and transaction fraud, recent legislation mandates reporting of transaction and trade anomalies. Non-compliance carries severe penalties, as evidenced by TD Bank's $3 billion fine and ongoing DOJ investigations across the industry.

Precision Analytics of Commodity Data Is Rich with Intelligence

- Trusted Government and Financial Institution Analytics

- Leverages proven Deterministic AI and machine learning

- Aligns with agency requirements for responsible, accountable AI

- Built on established methodologies trusted by law enforcement

- Advanced Pattern Detection

- Identifies suspicious trade signal anomalies in commodities, trade, and other data

- Analyzes weights, dimensions, and international pricing

- Surfaces patterns indicating fentanyl trafficking and money laundering

- Unique Data Convergence

- Combines private and public big data sources

- Reveals patterns that evade traditional detection

- Enables comprehensive analysis of global trade flows

- Modern Cloud Architecture

- Secure data collection and storage

- Advanced collaboration and asset management

- Powerful search and analytics capabilities

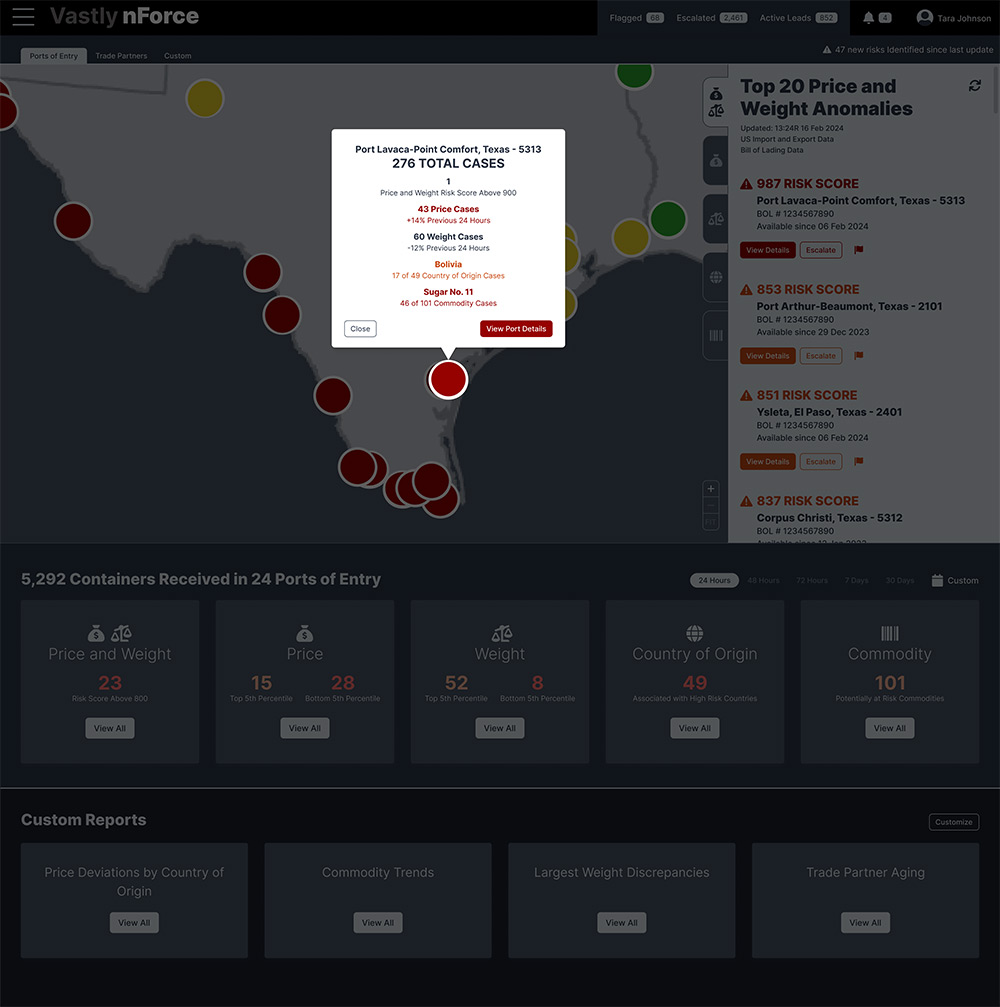

- Actionable Intelligence, Agency or Institution User Dashboard

- Transforms complex data into clear insights

- Streamlines case management and investigations

- Enables rapid response to emerging threats

Determinative AI and Machine Learning

Deterministic AI (DAI) and machine learning (ML) are familiar to government agencies and the private sector as a trusted and responsible approach to analytics. DAI is a proven and preferred analytical method for identifying anomalies in trade and commodity-based data and detecting malicious patterns that identify suspicious activity in many trade-based categories, including fentanyl, trafficking, and money laundering, and KYC among others.

Advanced Tools

G2Lytics harnesses it’s advanced tools and techniques to quickly identify and expose domestic and international illicit activities, placing specific focus on known data elements and signal anomalies such as commodity-based data, weights, dimensions, international pricing available through convergence of private and public big data sources and G2Lytics analytic techniques.

These trends and anomalies follow the patterns of illicit activity and often go undetected without automated analytical methods. Newer LLM and RAG models can be embedded once proven reliable, secure, accountable and acceptable to environments requiring auditable and highly accurate findings.

What Differentiates nForce™ From Other AI Platforms

Fraud targeted AI requires a unique ability to cleanse and harmonize the relevant data, followed with one of a kind subject matter expertise resulting in a disciplined understanding of data anomalies and trends. This understanding of how and what to identify specific to fraud is where G2Lytics excels. Whether locating fraud in trade-based money laundering, export controls or government funded programs, our subject matter expertise is critical to targeting, identifying and delivering clear and present actionable intelligence. G2Lytics reporting platforms can be used to visually explore data, identify intended and unintended suspicious activity and return results in highly intelligible and actionable formats. Continuous client feedback and validated data results are used to train more accurate and precise algorithms in a continuous improvement lifecycle.

Security

G2Lytics fully understands and agrees with the necessity to safeguard all information. As such, our applications are supported and layered with data industry partners in Trade Based Money Laundering and financial data considered leaders In data management, storage and compliance in their respective Industries.